Chris Welsford has presented the Keynote speech to fund managers and advisers at this year’s Investment Week Sustainable Investment Conference in London last Friday.

Chris’s presentation looked at the apparent mismatch between investor requirements and what they are offered by the Socially Responsible Investment funds industry. The presentation drew on research carried out by Tridos Bank and Mining Watch Canada.

Investment Week Ethical & Sustainable Conference – Key Note Speech

I have a confession to make. I am in the somewhat conflicted position of being a long time member of Greenpeace and a Formula One fan. I do spend a lot of time squaring this paradox. It is not lost on me that my justification for F1 is similar to some of the justifications used by SRI fund mangers when they invest in rather less than ethical companies. The difference though, is that I am not being bought for my ethical purity. If I were, then I’d definitely be out of a job!

The reason I am sharing this with you, apart from the useful analogy, is that it illustrates the complex nature of our lives and the likely paradoxes that we face when trying to untangle investor objectives, particularly when it come to ethics. It also provides me with an opportunity to share with you something that Anthony Hamilton said after his son Lewis Hamilton won the world championship on Sunday, which struck me as particularly apt for this presentation.

He said:

“If you apply yourself decently and honestly, things happen and the right things happen all the time”.

Sadly for many investors in SRI funds, despite titles such as ‘ethical’ and ‘Socially Responsible’, the right things do not seem to be happening all the time.

The misalignment of ethical investor expectations and SRI fund management provision has been well documented in a piece of research conducted last year by Tridos Bank. My objective today is to examine the nature and consequences of this mismatch and try to suggest what might be done to make the right things happen all the time.

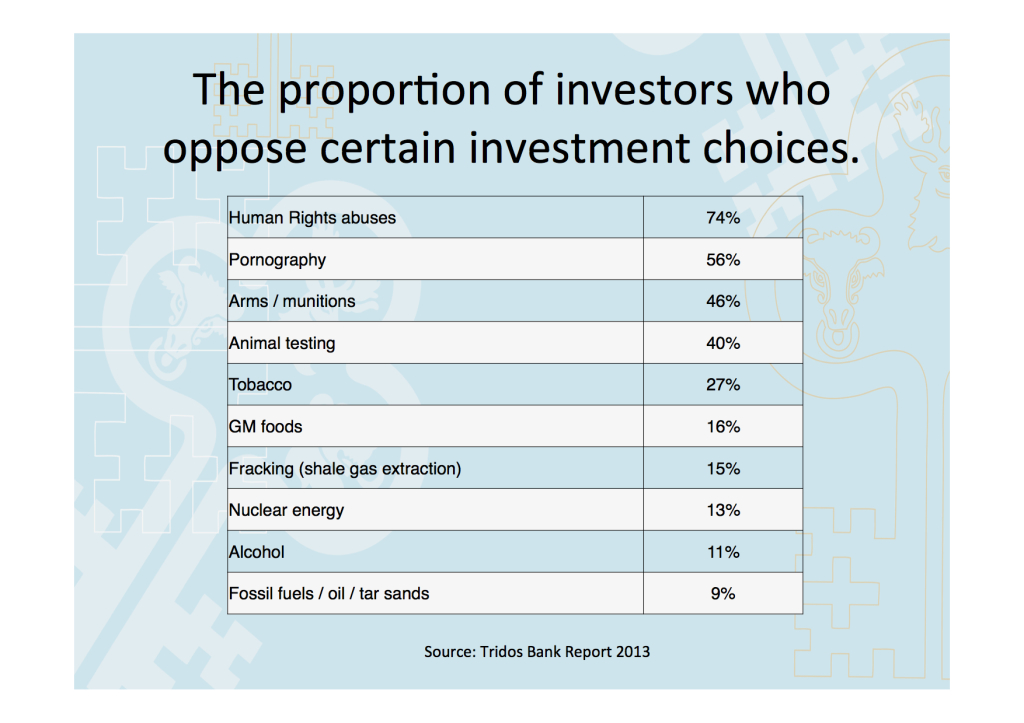

Many of you will already have seen this table from Tridos, which shows the proportion of investors who oppose certain investment choices. Note the word ‘oppose’. The focus is on opposition to certain activities. Ultimately this is what protest movements are based upon and I’d like you to hold that thought for a moment.

The Tridos report mirrors our own research and client experience in that we have found that the majority of investors have ethical concerns but find it difficult to satisfy these as a result of the failure of many SRI funds to live up to expectations, investing in companies that these investors do not consider to be ethical.

The Tridos research looks at the priorities set by investors and reveals Human Rights at the top of the list.

Our own experience as a firm partially supports these findings but we see far more people expressing opposition to tobacco and environmentally damaging activities than is indicated by the Tridos findings. We also see clients expressing a desire to invest in positive sustainable environmental activities such as renewable energy and waste reprocessing.

Our own experience as a firm partially supports these findings but we see far more people expressing opposition to tobacco and environmentally damaging activities than is indicated by the Tridos findings. We also see clients expressing a desire to invest in positive sustainable environmental activities such as renewable energy and waste reprocessing.

But ultimately they are looking to avoid exposure to companies that they believe are damaging the planet and contributing to the problem of global warming.

Our research into fund holdings confirms that there are funds calling themselves ethical who are investing in companies that many investors would find unacceptable. Examples include: Royal Dutch Shell; HSBC; Barclays; RBS; Lloyds; Aviva; Legal & General; BHP Billiton; Barrick Gold; Tesco; Pepsico; Macquarie; Standard Chartered Bank and Trinity Mirror Group amongst others: all companies that for an ethical investor would raise more questions than answers and justify the old rugby mantra, ‘if in doubt kick it out’.

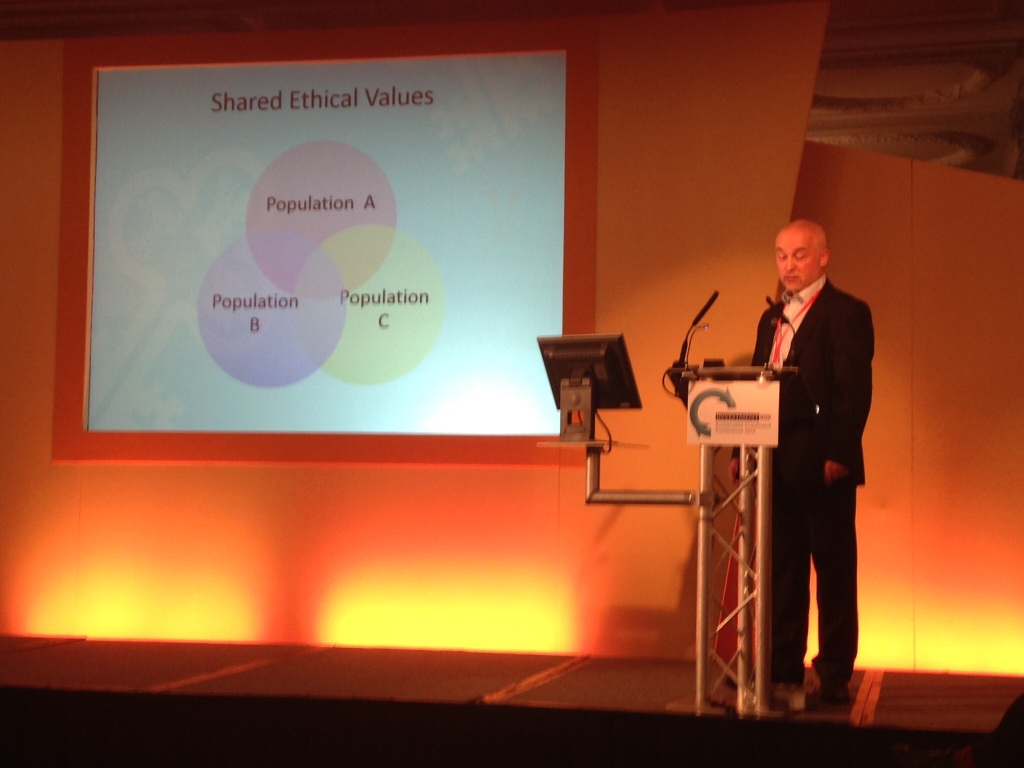

Many investors are members of groups that are collectively opposed to such activities. These range from high profile direct action groups such as Greenpeace to the campaigning and letter writing of human rights organisations such as Amnesty International. Others barely realise that they are part of the protest movement, belonging to popular groups such as the RSPB; the Wildlife Trusts and the Campaign for the Protection of Rural England.

Ultimately these groups represent the views of millions of people who are investors in SRI funds. It follows then that SRI managers should be listening to and gaining an understanding of the views of these organisations to better understand the requirements of ethical investors.

Ultimately these groups represent the views of millions of people who are investors in SRI funds. It follows then that SRI managers should be listening to and gaining an understanding of the views of these organisations to better understand the requirements of ethical investors.

Many older supporters of these organisations began their involvement at a young age, often at university. This is still the case today.

Many of them are now professional people, with careers behind them, who still care and still belong to these groups. They want to invest ethically in funds that won’t expose them to the very things they have spent their lives opposing.

Many of them are now professional people, with careers behind them, who still care and still belong to these groups. They want to invest ethically in funds that won’t expose them to the very things they have spent their lives opposing.

Ethical and sustainable investment strategies will of course be the winners in a world that is becoming increasingly democratised with good corporate governance and high ethics in business topping the political agenda together with action on global warming and human rights.

Ethical and sustainable investment strategies will of course be the winners in a world that is becoming increasingly democratised with good corporate governance and high ethics in business topping the political agenda together with action on global warming and human rights.

So, there are very sound financial reasons why investors will benefit from SRI. Deviating from this, even partially, will be damaging to the long term financial outcome and more importantly for ethical investors, it will fundamentally compromise their prime objective: Ethics.

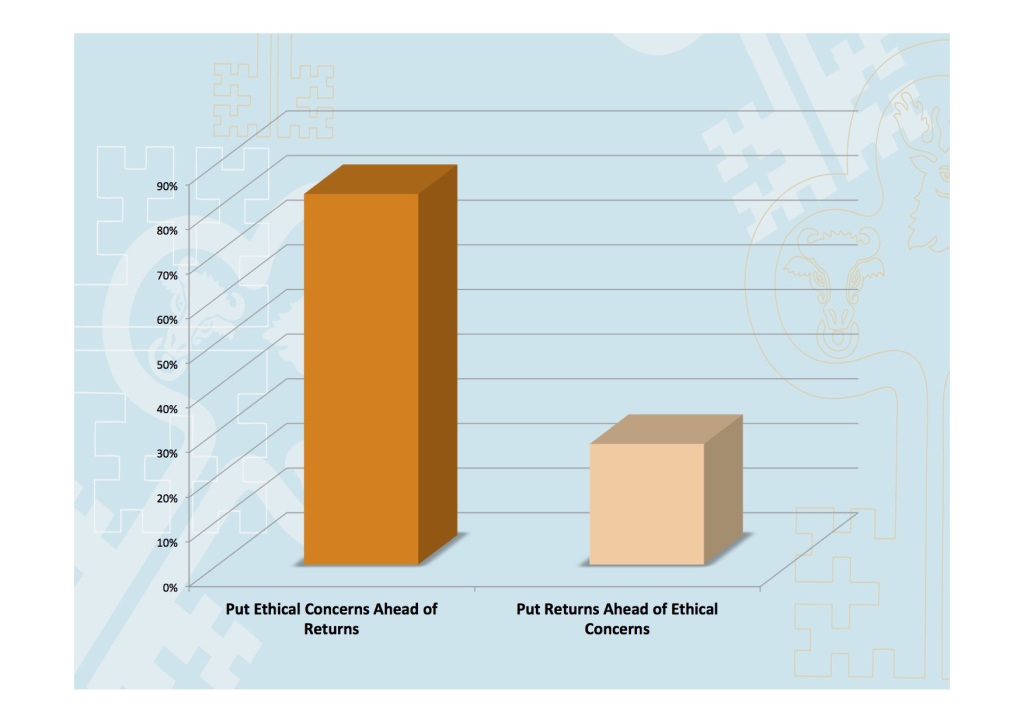

The Tridos research shows that 83% of investors are prepared to put their ethics ahead of returns. That is a very significant figure and it accords with our own data. What we have found however is that investors often feel they may as well compromise on their ethics when they understand how difficult it is to be sure that SRI funds are going to deliver what they promise. It is for this reason that many would be ethical investors end up with blended portfolios. Whilst this certainly provides the best opportunity for competitive returns, as evidenced by a CFA paper published earlier this year, it does not allow them to meet their prime objective of putting their ethics ahead of returns.

The Tridos research shows that 83% of investors are prepared to put their ethics ahead of returns. That is a very significant figure and it accords with our own data. What we have found however is that investors often feel they may as well compromise on their ethics when they understand how difficult it is to be sure that SRI funds are going to deliver what they promise. It is for this reason that many would be ethical investors end up with blended portfolios. Whilst this certainly provides the best opportunity for competitive returns, as evidenced by a CFA paper published earlier this year, it does not allow them to meet their prime objective of putting their ethics ahead of returns.

A further reason for opting for this approach is the apparent divergence of objectives between investors and fund managers. In order to meet their ethical objectives, investors are prepared to sacrifice returns, particularly in the short and medium term, looking more towards the long term for their reward. This approach may be at odds with a fund management industry that often appears to be more concerned with achieving competitive short and medium term returns with which to attract new investors and to justify remuneration. Could this be a further reason why unethical companies find their way into SRI portfolios?

A further reason for opting for this approach is the apparent divergence of objectives between investors and fund managers. In order to meet their ethical objectives, investors are prepared to sacrifice returns, particularly in the short and medium term, looking more towards the long term for their reward. This approach may be at odds with a fund management industry that often appears to be more concerned with achieving competitive short and medium term returns with which to attract new investors and to justify remuneration. Could this be a further reason why unethical companies find their way into SRI portfolios?

Justification for unethical inclusion, seems to fall into two categories: Engagement and or Compromise.

We all understand Compromise, which emphasises the positive and uses percentage limits to screen out the negative. It all comes down to the extent to which you tolerate those negative activities as a percentage of company turnover.

We all understand Compromise, which emphasises the positive and uses percentage limits to screen out the negative. It all comes down to the extent to which you tolerate those negative activities as a percentage of company turnover.

This may fly in the face of an all or nothing approach and for some hard-line investors may prove unacceptable. For the majority though, compromise on a defined and limited basis will work.

Unfortunately some SRI funds appear to be using compromise to permit investment in companies that have no place in any ethical portfolio.

Whilst ethics are complex, some things are blatantly unethical to most people.

The Tridos research indicates that Human Rights is one such a common factor. It would not be unreasonable then to assume that extreme human rights abuses, such as murder, rape, arson, abduction and intimidation, would be considered unacceptable to most people. From this it follows that we should exclude any companies for which there is any question regarding involvement in, or tolerance for, such activities.

But what about activities that only minority groups consider unacceptable? The Tridos research tells us that only 27% of investors are opposed to tobacco stocks in their portfolios. Whilst we believe around 60% of our clients feel this way about tobacco, it is the one area upon which all SRI funds seem to agree. Tobacco has universal rejection! Other factors that rate far higher do not receive the same negative treatment, despite being opposed and unwanted by ethical investors. We have to ask why this is?

Looking at the way in which SRI funds and some religious organisations justify the inclusion of banks, variously accused of: funding illegal cluster bomb manufacture and unethical and environmentally damaging mining projects; manipulation of financial markets; money laundering; wide-spread mis-selling of PPI insurance and other regulatory breaches, it appears that some SRI fund mangers will do almost anything to include them in their portfolios.

We see them blithely accept almost any explanation, denial and reassurance from these corporations, despite evidence to the contrary, often provided by pressure groups involved in uncovering this type of wrong doing, not to mention regulatory intervention, legal proceedings, fines and sanctions that leave no doubt about the culture and poor ethical values that pervade these organisations. This is not the best way to satisfy the investment needs of ethical investors who, as we have seen, prioritise their ethics ahead of investment returns.

So, what about Engagement?

On the face of it engagement with the boards of investee companies by SRI funds sounds like a positive idea. So, what’s wrong with trying to use shareholder power to influence an unethical company to change its ways?

Our interest in the rather less than positive aspects of engagement began when we first noticed that some potentially controversial mining and extraction companies are included in a number of SRI funds held by our clients. Engagement appears to be the main justification for these holdings and without further examination one could be forgiven for accepting this as a positive example of investor power doing its bit for human rights and the environment.

On further investigation we found that despite glowing accounts of their good works on their corporate websites, the evidence provided by local pressure groups and residents associations reveal a very different version of events, including allegations of rape, assault, intimidation amounting to widespread human rights abuses and environmental destruction. Whilst many will seek to challenge such assertions, when assessing suitability for inclusion on ethical and sustainability grounds, SRI Funds need to be far more challenging to better meet the requirements of their investors, who are far more likely to be on the side of the protestors.

It might be helpful to reflect that the protest by mostly English middle class residents against the Bexhill to Hastings Link Road was no more or less legitimate than the protest of local people in Columbia against the expansion of the Cerrejon Coal Mine, part owned by BHP Billiton. Possibly a significant difference was the ability of the protestors to articulate their concerns and fund their protest and gather powerful support.

Given the importance of human rights issues to investors, I think it is incumbent on all of us to give serious consideration to the possibly negative implications of engagement in this respect.

Anthropologist Catherine Coumans is a research coordinator for Mining Watch Canada. In 2012 the Journal of Sustainable Finance & Investment (Vol. 2, No. 1, January 2012, 44–63) published a paper by Coumans entitled “Mining, human rights and the socially responsible investment industry: considering community opposition to shareholder resolutions and implications of collaboration”

The paper considered the human rights implications of engagement by Canadian SRI firms with Canadian mining companies in which they own shares.

The paper documents regular allegations of human rights abuses related to their mining activities. Coumans analysed shareholder resolutions and the relationships and collaborative undertakings between SRI firms and Goldcorp, assessing their impact on the communities affected by mining; the effect on their efforts to oppose those activities and the consequences for community agencies, working to defend social and environmental values.

The paper concludes that a relationship Goldcorp entered into with SRI firms through a shareholder resolution led to a flawed human rights impact assessment process that was protective of the company’s interests but harmed the ability of affected communities to defend their interests.

In another paper published in 2011, entitled “Occupying Spaces Created by Conflict : Anthropologists, Development NGOs, Responsible Investment, and Mining” Coumans raises numerous examples of abuse and concludes that whilst many academics, developmental experts and socially responsible investment firms undoubtedly engage to be positive agents for change, there are financial and ethical risks that appear all too often to be understated or overlooked.

This paper is essential reading to anyone involved in SRI who is considering engagement as a justification for investment. It draws attention to the damage that can be done through engagement and collaboration by well intentioned SRI Funds that fail to understand and properly engage with the needs and objectives of local indigenous communities affected by corporate interests.

It also notes the way in which SRI funds become aligned to the interests of the corporations in which they have a financial stake, often prioritising returns above ethical concerns bringing us back full circle to the misalignment of investor and fund manager objectives in many SRI funds.

So in summary we have a number of issues to address. The inclusion of unethical investments in ethical funds raises moral, ethical and ultimately regulatory consequences, which I believe many fund managers think they can avoid because of the seemingly intangible nature of ethics. They mistake the philosophical for the scientific and in so doing they fall into a trap that is both commercial and potentially regulatory. Too many are invested in too blatantly unethical areas to be able to claim reasonable doubt as a defence. TCF should be flashing red warning lights at this stage. Many already recognise this and are repositioning, rebranding and redesigning to avoid the likely consequences.

Greenpeace Oil Giants Invade the Arctic (reproduced with the kind permission of Greenpeace)[/caption]

I don’t think this will be enough. With RDR came far greater onus on advisers to carry out more professional and in depth due diligence on behalf of their clients. Advisory firms like ours will become far more demanding and this in turn will mean that clients who want SRI and are prepared to prioritise ethics ahead of short and medium term returns will be directed to purist funds that understand this client requirement.

Opportunities for Ethical DFMs and research oriented investment IFAs, to assist clients in achieving their ethically driven investment objectives, will grow. Ethical investment perhaps provides the ultimate opportunity for bespoke investment.

Single issue or thematic funds need to be made far more attractive and accessible to the retail investor. Many of these funds, whilst investing in very laudable, ethical and financially lucrative projects, are unregulated and offshore domiciled. This places them out of bounds to all but the most sophisticated investors. This is a shame in my view.

We need to find ways to make it easier for single issue and thematic funds to gain UK regulatory authorisation and become UK domiciled, to provide investors with the same protections they receive from other more mainstream packaged funds.

In so doing we will open the way for ethical and sustainable retail investment in areas such as recycling, renewables, sustainable forestry and projects that benefit impoverished and disadvantaged communities globally.

Others not prepared to play fair with ethical investors should head for the door now before reputational issues surrounding their failed attempts at SRI affect their successful conventional mainstream funds, raising questions about their fair treatment of customers and ultimately their ethics.

By acknowledging and accepting that we are serving the needs of a specific and unique group of investors, who prioritise ethics over returns, we can deliver what they are asking for without outlandish compromise, or potentially destructive engagement.

Chris Welsford

26-11-14

Warning: Investment returns are not guaranteed. The value of investments and their associated income can fall as well as rise. Past performance is not a guide to future returns. This presentation represents the views of the author and does not constitute investment advice and no action should be taken or investments made as a result of its contents.