Let’s Play Hunt the Straw!

Increased volatility and massive gains on the S&P500, the USA’s main share index, coupled with concerns raised by the IMF (International Monetary Fund) this week, that bond markets are also over heating, in particular high yield bonds, mean we need to try and understand what is happening and consider what might be the financial ‘straw’ that eventually breaks the ‘Camel’s-Back’, triggering off a worldwide slide in share and bond values, something that could have consequences for all our portfolios.

Shares in many of the world’s leading economies rallied over the last two weeks. The FTSE 100 remaining above the coveted 7000 mark for the last few days. Over the last month though, it was not the so-called developed world that took the prizes for best performance. China’s Shanghai Index made large gains, having recaptured all the lost ground of the last five years and re-entered the territory given up during the 2007-09 crisis. But it is Russia with a stellar 30% that takes the prize for the Worlds top performing market over the last 30 days.

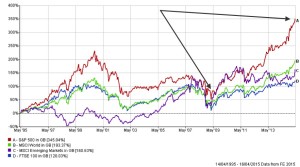

But whilst these are remarkable recent recoveries it is the S&P500 that has made the greatest recovery since the depths of the Credit Crunch in March 2009.

200% over 6 Years!

Over that 6 year period the S&P500 gained almost 200%, outpacing all the other developed markets and the emerging ones too. It left the FTSE100’s 100% rise over the same period looking like a very poor cousin indeed.

These are very large increases indeed but perhaps hardly surprising given the depths plumbed by the 2009 crisis which was followed by recession in many countries and an unprecedented rebuilding of the global money supply by all of the leading central banks through QE (Quantitative Easing).

Clearly the liquidity introduced by QE has led to the vast recovery seen in the markets and helps explain the low levels of accompanying consumer price inflation, which in the UK is zero for the last year. In the USA inflation is also very low and it is clear that the recent decline in the price of oil has played a significant part in achieving this. Ordinarily one would expect an increase in the money supply to be inflationary but if that increase does not find its way to consumers’ pockets in the form of increased wages and the wherewithal to exploit low interest rates, then there will be no inflation and this is exactly the position we find ourselves in today.

The big question for investors however, is how long can this last? Will the end of QE and the raising of interest rates trigger a downward slide in shares and bonds or will it be something else? With the S&P500 having climbed so steeply in the last 2 years, will it be there that the next crash starts? Should we be worried that the value of shares and bonds, the principle components of all our portfolios, might fall as a consequence?

US Decoupling has not happened

The chances are that a combination of factors will play their part but what is clear is that a tumble for US shares is likely to have a severe knock-on effect globally. There are many reasons for this, the principle one being the dominance of the USA as an importer and trading partner with almost everyone. If the US catches a cold then pretty soon we all do. For many years we have discussed the theory of decoupling, where the USA becomes less connected to other markets and less of a catalyst for global market movements, but it is clear that this has just not happened. The US remains massively influential and perhaps more so today than it ever was. So, a significant drop in US share prices will lead to share price falls elsewhere but what might trigger such an event?

The triggers for crashes are often not fully understood

Post mortems on the 2000 Dot-Com Bubble bursting and the 2007-09 Credit Crunch and Banking Crisis, revealed obvious over valuations, trigger points and causes. It was not so obvious in the case of the 1987 crash. It is only after many years of analysis that we can understand how the introduction of electronic trading introduced additional volatility into the markets. Faster order execution and dealing made it easier and quicker to buy and sell shares and opened the market to private investors whose propensity to panic did not help matters when markets began to reverse gains made over the preceding years.

Whilst electronic trading, volatility, greed and fear remain a fact of life for us today, it is useful to understand the reason why markets start to fall in the first place. That is to say, what triggers crashes and is there one factor that can be identified as always responsible, or would that be far too convenient?

“Was Volatility in the Price of Oil a Cause of the 2008 Financial Crisis?”

A group of investors, some with a scientific and geophysical background have proposed a theory that suggests signals from changes in the price of oil could be indicators of future financial crises including larges falls in the price of shares as well as recessions and therefore bond market turbulence. This is an interesting hypothesis based on the importance of oil as a diminishing resource and I feel it is worthy of further consideration.

In December 2009, New Zealand medical professor and biologist Tom Therramus published an essay titled: “Was Volatility in the Price of Oil a Cause of the 2008 Financial Crisis?” The article was posted on “The Oil Drum”, a website for those concerned by the issues raised by Peak Oil and the energy crisis.

Therramus’s theory is that signals sent by volatility in the price of oil, provide an insight into the timing of economic recessions and stock market crashes. Focusing on the crisis at that time he argued that the 2008 banking crisis and the subsequent recession was triggered by a series of increasingly large spikes in the volatility of oil prices.

To prove the relationship he looked for evidence going back to 1966 and collected oil price volatility data that showed similar spikes prior to and immediately after, significant economic and market crises. He challenged the conventional explanations of these crises offering instead the uncertainty of oil production, supply and demand as an alternative. The consistency with which series of spikes in oil price volatility and crisis in the financial markets occurred seemed compelling.

Will Collapse In Oil Price Cause a Stock Market Crash?

Therramus wrote a further article every two years, the most recent: “Will Collapse in Oil Price Cause a Stock Market Crash?” co-authored by Steve Austin was published online on the 14th January 2015. The main thrust of the paper is that today the signals from oil price volatility, received prior to every other major crash have already been seen and the sharp fall in oil prices experienced in 2014 mark the final pre-event (crash, recession or both) point, a precursor to something serious occurring in the next 6 to 12 months. If this does not happen then it would seem that this would be the first time that such signals will have proved meaningless.

In a world that often witnesses apparently irrational and unexplainable changes in the value of shares, we need to take such ideas seriously. Whilst irrational exuberance, fear and greed provide behavioural explanations, more physical causes are not so easy to understand until considerable hindsight can be exercised, sometimes years after an event.

A causal relationship or pure coincidence?

This theory could help to provide a more cohesive explanation for all economic downturns and stock market crashes, including previously difficult to fathom events such as 1987’s Black Monday (or Tuesday if you’re in the USA) but one needs to be careful not to attribute causal relationships to otherwise unrelated events.

By explaining the effect that falling oil prices have on the global economy in terms of oil industry infrastructure and supporting ancillary industries, the Therramus / Austin hypothesis does appear credible. The theory may help explain the recent falls in high yielding bonds and the stagnation in share valuations and yields experienced over the last year for many of our clients. This is despite the fact that the funds we are invested in, are not dominated by oil company stocks or associated industries; exhibit low default rates and continue to provide competitive yields, making these bonds attractive to income investors.

The fact that prices of high yield bonds have been subject to pressure as demand grew over the preceding five years is a significant factor that must not be discounted. There always comes a tipping point. The record levels reached by the S&P500 for shares is also indicative of an overheating with irrational exuberance and investor greed playing a significant role, making many wonder when fear will replace greed and send the market into decline. Could the trigger for such an event be what Therramus and Austin believe?

Explains the Indiscriminate Sell Off of High Yield Bonds Over The Last Year

Therramus and Austin say: “The mechanism by which a fall in the price of oil could trigger a collapse in the stock market lies in the financial devices used to fund oil exploration and exploitation throughout the world, and particularly in the United States. Modern oil exploration is financed through a range of methods including issuance of shares to increase capital, and raising debt through bonds and bank loans.”

Their report explains the reasons for this lack of discrimination on the part of high yield (junk) bond investors:

“Today with oil under $50, many producers lose $20 for every barrel produced and will likely default on these loans….This loss will be passed to the banks that made the loans, as it happened with the housing sector in 2008. A tell-tale sign of this is the recent 20% fall of high yield corporate bonds since this summer which follow very closely the fall in crude oil prices. Many investors are afraid of defaults in the high-yield market due to over-lending to the energy sector and are indiscriminately selling off “junk bonds.” The downside of this corporate bond selloff across the board is that less favorable financing options will be available for other sectors, which in turn will spread the slowdown to the rest of the economy.”

Many factors interact to create the market swings experienced by investors

Although oil undeniably plays a huge roll in determining the price of almost everything that is produced today, wages also take a similar place in the economic process. Markets don’t always listen to economic arguments and we often see them moving up or down despite the wider economic picture. Behavioural factors: fear; greed and irrational exuberance, certainly play their part in moving markets, more than economics, particularly in the short term.

However the price of oil has a provable link to inflation and this influences the monetary and fiscal policy of individual countries and trading blocks. Oil is used in the production of almost everything and it is possible that the effect of oil and the pressures created by Peak Oil have been underestimated.

Perhaps we should be more willing to accept that oil prices are influential and that Therramus & Austin may have gone a long way to establishing a causal relationship.

What should we do?

This lack of discrimination in high yield bond valuations is exactly what we have witnessed over the past year. For clients reliant on the income from their investment portfolios, who are unable to reconcile a defensive withdrawal from the market in order to preserve their capital with remaining invested to maintain their often high levels of income, this is now an extremely dangerous time. The alternatives are not palatable either and may represent the best of a bad bunch. The low level of cash interest available makes cash very unattractive. The market risk for shares and high yield bonds makes them unattractive too, whilst interest rate risk makes lower yielding corporate bonds potentially risky, assuming interest rates do rise any time soon.

Gold and other commodities may provide shelter but in the short term these are not without significant risk. It may be worth casting our minds back to James Montier’s argument for holding cash and recognising the in a low to zero inflation environment even nil interest cash holdings can be attractive when one is faced with the serious prospect of a full blown crash. However, in such circumstances investment grade bonds, although susceptible to interest rate risk, would most likely rise against a declining equity (share) market and any prospect of rising interest rates in the midst of a crash and possible recession seems unlikely.

Moving out of shares and high yielding bonds could be risky – only time will tell.

If the Therramus / Austin hypothesis is correct, should we be moving out of shares and high yield bonds and into cash and investment grade bonds? Could such a move be a gamble? Reducing diversification in this way could also prove very risky. Much depends on the type of investor and their long-term objectives.

For cautious investors this is likely to be a difficult and possibly unnecessary call to make. By accepting the prospect of a share market crash is real, any long term hedging of bets, otherwise known as diversification of assets, through risk driven asset allocation, would have to end in the short term, driving up asset specific risks should the analysis prove unfounded. The caveat that past performance, and in this case, repeats of past events and apparent causal relationships, is not guaranteed should be considered seriously in this respect. The consequences for investors would be that income levels would decline as we move out of higher yielding assets into hopefully safer areas. If this evolved into a wait and see of more than a few months then it may be difficult to justify action to avoid a crash particularly if portfolios are already correctly positioned avoid the worst consequences of a crash.

For cautious clients who are not reliant on their investments for income, the cash option might be acceptable. However, as we know, the damage done to more cautious portfolios by a share market crash is usually limited, as they hold fewer shares and more bonds and cash anyway.

Moderate and Adventurous portfolios are far more at risk as they hold significant amounts of shares and high yielding bonds. In these cases lower yields need to be accepted in the shorter term, with a move to a far more cautious cash and investment grade bond based approach being adopted as a short term defence against the likelihood of turbulent times ahead.

Be prepared. Make your plan and stick to it!

There is no point in reacting to events. Aftermath fire-fighting is invariably counterproductive. In the vast majority of serious corrections or crashes with magnitudes of more than 20%, lasting maybe three three years or so, by the time investors are aware a crash is in progress the market will have already fallen significantly and any reaction will simply capture the losses leaving no chance of future recovery. It is important to either take action in advance and miss out on the froth that constitutes the top of the market or sit tight and allow your portfolio to endure the downturn and enjoy the subsequent upturn. This strategy needs to be understood before events unfold and then held to.

Chris Welsford

17/04/2015

A PDF Version of this article is available here: Keynotes April 2015

Important Risk Warning – Please Read

It is important to understand that this report is not intended as specific investment advice, only my opinion in broad generic terms, designed to provide a flavour of the markets and possible future outcomes based on the possible evidence at our disposal.

The value of investments can fall as well as rise and they are not guaranteed. Past performance is not a guide to future returns and you may get back less than you have invested.

If you are at all concerned about your specific situation and the investments you hold and you are not due a review soon, then you should contact us as a matter of urgency and we will review your attitude to risk and your portfolio to ensure it meets your requirements and is adequately protected from the prospect of a share market crash.