Welcome to 2022, the worst start to a year for socially responsible investment ever! It’s not been great in the conventional investment world either, but we do seem to be experiencing something of a sustainability reversion where oil related investments are outperforming renewables.

It should be a short-term situation, but it may last a while as fears over global heating fail to translate into meaningful corporate and governmental action and humanity rushes to return to the pre-pandemic ‘normal’ of global free trade, international leisure, and business travel.

After all, who needs Zoom when you’ve got an 8-hour transatlantic flight to enjoy!

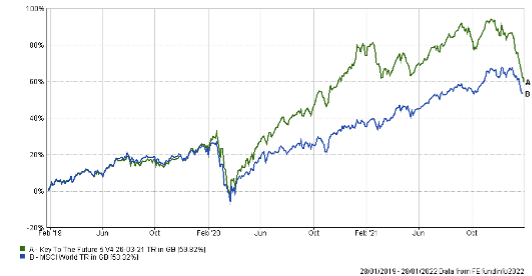

This return to normality may help explain the recent outperformance of more conventional investments over sustainable ones and the extreme volatility experienced by sustainable investments over the last 12 months. It doesn’t explain the large fall in all markets since December that have been most pronounced in sustainable investments:

The MSCI World Index (measuring the composite returns of all the worlds listed stocks) is down more than 8% since the end of December. The aggressive Key to the Future 5, most closely aligned to the MSCI World Index, is down 14% in the same period.

Whilst the stock markets hate uncertainty, they also hate high rates of inflation that could lead to rising interest rates. Supply chain shortages and weak consumer demand pile pressure on corporate earnings. Energy price rises and threats of disruption to energy supplies, a feature of the current tensions over Ukraine, all conspire to make this a perfect storm.

Adding to this the fact that shares with a sustainability focus rose so much in 2020 has made them particularly vulnerable to a ‘mean reversion’ – where something that has moved significantly from the long-term average is shifted back to that average by the various factors in play during a crisis. In other words, it got ahead of itself.

It is perhaps useful to cast one’s mind back to what happened when the Global Pandemic struck in March 2020. The most vulnerable parts of the global economy were the conventional oil-based sectors. The price of oil plummeted and globally, share prices fell massively in value. The world’s oil fuelled transport systems came to a resounding halt, causing commercial activity to cease. Factories closed and supply chains collapsed.

It seemed that there was no prospect of anything returning to normal anytime soon. Sustainable investment portfolios fell too, but unlike more conventional oil-related investments, sustainable investments generally recovered more quickly and extended their gains further in the recovery of 2020.

Much of the outperformance can be attributed to the belief that the pandemic had led to lasting change in both personal and commercial behaviour and encouraged alternative business practices around remote working and less carbon intensive practices that would endure even if we got through the pandemic. In essence, nothing would ever be the same and we were witnessing the start of the low carbon transition.

With hindsight, this was a monumental overreaction to a relatively short-term threat. Stock markets have a habit of over-extending human fears beyond any logical conclusion. Although at the time the market reaction seems to reflect reality, it is often only with considerable hindsight that the market reaction can be truly understood.

2021 opened with the first serious shock to the new ‘sustainable’ order. A bubble had been forming during 2020, in energy technology shares, led by hydrogen cell innovators such as Plug Power Inc, a US based company engaged in the development of hydrogen fuel cell systems that replace conventional batteries in equipment and vehicles powered by electricity.

The bubble burst in early 2021 leading us to revaluate our weightings in the energy sector in our more cautious portfolios. Energy continued to create volatility in the sustainable space all the way through 2021.

This, coupled with a completely new set of uncertainties, the hope that the pandemic would soon be over, has led to a wider-spread retreat for the markets, both sustainable and conventional. Rising inflation, beginning in the US and then in Europe and the UK led to fears of interest rate rises which impacted markets very late in the year and has since dominated the start of 2022.

The build up to, and eventual failure of COP21 to reach any meaningful agreement on an urgent and immediate start to a climate-disaster-averting energy-transition away from coal oil and gas led to confidence returning, in fossil fuel investments, leading to a dramatic rise in the price of oil and gas with soaring energy prices across the globe. The resulting short-term uncertainty in the value of renewables has caused much of the protracted fall in sustainable share values.

Covid-19 and the resulting labour shortages in the Far East are responsible for the massive supply shortage in semi-conductors that has, in part, led to the lowest UK car production figure in 65 years. The closure of the Honda plant in Swindon comprises 25% of the UK decline. But more importantly, internationally the effects of the shortage are unlikely to be resolved until 2023.

Globally, this has caused a shrinkage in corporate earnings growth predications and compounded the effect of inflation on share valuations. This has been particularly acute in the North American technology market, an area of particular interest for sustainable investment funds which have been significantly impacted. Inflation is a factor in the calculation of share prices.

When analysts are presented with steeply rising inflation data, this has a negative effect on the net present value of shares which is probably the leading cause of the fall in values globally, as well as in the USA.

Pressure on interest rates, because of central banks such as the US Fed seeking to control risking inflation, is putting downward pressure on bonds. Bonds are supposed to provide protection when shares are under pressure. Rising interest rates cause the value of bonds issued to fall. New bonds are eventually issued with higher more competitive rates of interest, and these will eventually find their way into the bond funds we hold in the Key to the Future model portfolio, but this will take time.

The situation in Ukraine is the final factor in the mix. The political reasons for the conflict are based in territorial claims and counter claims. September 2021 marked the 30th anniversary of the vote in the Soviet Congress of People’s Deputies to allow the dissolution of the Soviet Union, leading to the agreement in December of 1991 setting up the Commonwealth of Independent States of Russia, Ukraine, and Belarus. Russia always found this a difficult reality to accept and has consistently maintained a position of authority when it comes to its relations with Ukraine and Belarus.

The NATO policy of open membership presents Russia with a particular challenge that threatens its authority and military standing as protector of what it hopes might one day be a modern expanded Russia that would include Ukraine.

Despite its lack of carbon neutrality, natural gas is often viewed as a transition fuel, and it matters who controls its extraction, production, and transportation. Ukraine has the second largest natural gas reserves in Europe and plans to be energy independent by meeting all its domestic gas demand internally by 2030. It is therefore no surprise to find that the so-called disputed regions of Crimea, annexed by Russia in 2014, and Dnipro-Donetsk are where these reserves are located.

The control of these vital gas reserves is at the heart of the conflict. It explains the attitude of the West, exemplified by NATO, the USA, the EU, of the Ukrainians themselves, and of Russia. In the coming energy transition, 900 billion cubic metres of Ukrainian natural gas is perhaps the biggest uncertainty for energy markets in 2022. Inflation and interest rates can be mathematically modelled, and shares and bonds revalued accordingly. Energy commodity prices don’t have the same ability in the face of what might become a serious conflict between the West and Russia.

Only this week, the Ukrainian president called on the West to stop inflaming the situation and stop portraying the threat of invasion by Russia as inevitable. In Russia the dispute is seen as the mirror image of how it is portrayed in the West. CNN reported that Russia sees the build-up of NATO forces on their western borders as provocation and a serious military threat that justifies the massing of Russian troops on the eastern flanks of Ukraine.

A Russian naval exercise is planned to take place in early February, 150 miles off the southwestern coast of the Republic of Ireland, in an area known as the Western Approaches. This is a strategically strong position should any conflict escalate. This training area is also directly above the largest submarine information cable in the world, which may be significant given that a similar cable running from Norway to Svalbard was recently cut. Essentially this is as close to a war with Russia as we can get without ‘being at war’, and the markets are rattled.

We should not be rattled by such short-term events even if the impact on investment portfolios has been serious. As we have seen in the past, declines are usually reversed relatively quickly. Our future focused sustainable and impactful philosophy remains a solid and sensible investment strategy.

The Key to the Future Model Portfolio comprises a diverse portfolio of around 400 companies and a wide range of bonds. One year is not a sensible indicator of long-term performance. We measure fund performance over periods of no less than 36 months. Periods of less than this tend to result in less reliable data that is unable to offer meaningful insights into likely risk and return characteristics and quality. We need to see the current difficult conditions as a short-term reversion, following a period of very good out performance. Eventually we should see the trend reverse and common sense prevail.